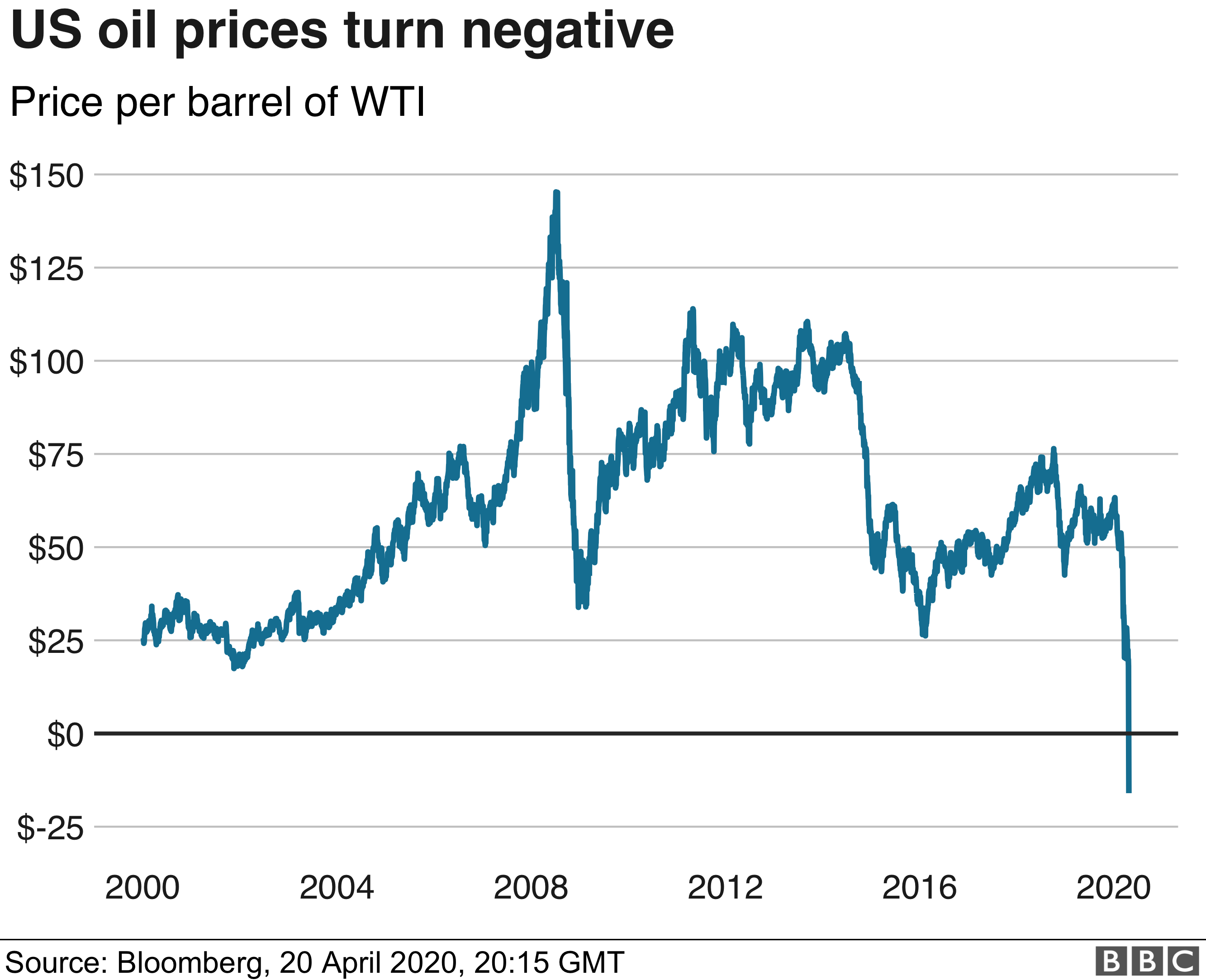

On Monday, April 20, the benchmark oil price in the US fell to $-37.63 due to the lack of demand caused by the current pandemic. Obviously, since many countries have issued shelter in place orders and travel bans, the demand for oil have drastically dropped to the point where traders are willing to pay to have people take oil out off of their hands due to limited storage. According to the New York Times, "Without a use for it [oil], the world’s biggest producers — the United States is high on that list — is running out of places to store all the oil that companies have continued to pump out of the ground". Since oil had a more inelastic demand curve, the operation to maintain a steady and consistent supply likely contributed to an inability to simply produce less oil.

This crisis is reflected in reflected in the nationwide decrease in gasoline prices, as oil companies struggle to profit with the rapid decrease in demand. From a consumer point of view, this doesn't make that much of a difference since the reason for the inelastic demand of gas was because we only bought what we needed and now since we don't need to get around, there is no reason to buy more gas.

Thanks for writing this post! It's a very important effect of the pandemic that we haven't really touched upon, but it could be detrimental to the U.S's economy. But why don't the suppliers just stop pumping oil out of the ground for the time being so the whole chain becomes static?

ReplyDeleteIt's difficult to turn oil wells on and off, and oil that's already been pumped can continue to flow down pipelines for weeks[1].

DeleteOn the post in general: another interesting effect is occurring in oil ETFs (exchange-traded funds, basically stock-like assets that track the value of some other thing, such as oil). As oil goes negative, oil ETFs are struggling to reorganize their holdings to avoid bankruptcy, leaving investors high and dry[2]. Many have been speculating that oil has nowhere to go but up, and may suffer large losses because of it[2].

[1] https://www.npr.org/2020/04/22/839851865/why-the-world-is-still-pumping-so-much-oil-even-as-demand-drops-away

[2] https://outline.com/zdVBmh (https://www.bloomberg.com/news/articles/2020-04-21/charlie-mcelligott-worries-biggest-oil-etf-could-go-lights-out)

This was an interesting post. I saw in the news that oil had a negative price and was confused by what that meant and this post did a great job explaining why that was. It will be interesting to see how the oil prices will change once this quarantine is over. Perhaps some businesses will hoard oil now and be able to sell it at a cheap price in the future.

ReplyDelete